Are you an employer trying to find information about the Cycle to Work Scheme? I feel your pain. With pages of information directed at employees and the benefits, I myself hunted (even as far as page 9 of Google!) for scant details on how this *actually* works for you, the employer.

I had all sorts of questions…

How do I pay Halfords? What if the employee leaves? Is it easy to process on Payroll? What is the process to apply / set up an account? Is there anything else I should know?

You’ve got more chance of finding Elvis riding Shergar, than you have finding clear answers to these questions online – believe me, I’ve tried. And I expect so have you, which is how you ended up here!

So let me try my best to share my experience of registering to Halfords Cycle to Work Scheme

How do I apply for Halfords Cycle to Work as an Employer?

Good question.

The link to apply can be found here – I strongly advise you don’t attempt to apply on Mobile, because, well, it just doesn’t work. Which is quite hilarious for the ‘UK’s Leading Cycle2Work provider’ (their words not mine) You will end up getting to the bottom of the form, only to find it doesn’t scroll any further, and nor will it let you proceed without telling them how you heard about this sh*t show of an application form.

The process is marginally less painful on desktop.

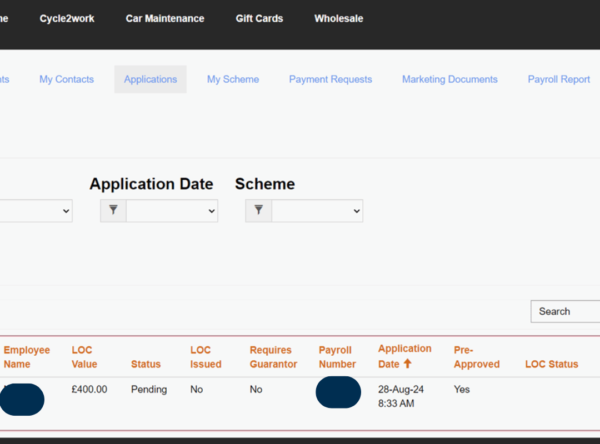

What does the Employer Portal look like?

The employer portal is very simple, very basic. It isn’t going to win any awards for User Interface anytime soon.

It makes Nest look like a beacon of innovation.

It doesn’t tell you how to approve an Application, or what happens next after you’ve approved it, so you may approve an Application then sit wondering what you should do next, as I did. As they don’t explain that it needs to be manually processed by Halfords at every stage and will take 2-3 days.

So sit back and wait!

How does the Employer pay for the Cycle 2 Work bike?

This may feel like we’re jumping the gun a bit, but I feel this is a very crucial piece of information that Halford’s conveniently omit until after you’ve told all your employees you’ve registered and they’ve started to submit applications.

You the employer has to pay for the bike upfront, to the value of their LOC (Letter of Collection) before any bikes start being chosen.

This might be a little annoying for cashflow, if you suddenly have 20 employees wanting a £1000 bike on a sunny weekend in August (Lol, joke, as if we ever have a sunny weekend in August)

Another detail Halford’s conveniently keep well hidden – is that any funds not used, do not get refunded. So if you have a LOC for £400 and you spend £393, the other £7 is pretty much a non-refundable tip. But if you have a letter for £400 and it comes to £401 you cannot put the other £1 toward it yourself, so you’d have to pick something else.

So my advice is, tell your employees to pick out what they want before they apply.

How does the Cycle to Work Application process work for the employer?

Step 1 – register using the link above to create an ‘Employer’ Account – you will specify the ‘maximum’ amount any employee can spend. The spend total is not just for the bike, but a helmet, and any relevant safety accessories (lights, mud guards, locks – sadly not storage racks)

Step 2 – you will receive an email saying your portal is now live and an ‘Employer Code’ for your employees to use to make an Application.

Step 3 – your employee (or yourself as a director – but don’t use the same email address as the ’employer’ or it will get very confused) makes an Application stating what value they want to spend.

Step 4 – you login to the portal and ‘approve’ it

Step 5 – at some point 1-2 working days later you will be sent an invoice to pay for the authorised amount, and once this is paid, at some point 2-3 working days letter, someone at Halfords approves it and a Letter of Collection is issued, allowing the employee to go and buy their bike.

Step 6 – your employee goes into store (or online) with their LOC and make your purchase.

Step 7 – you make ‘deductions’ for the monthly value of the bike from their gross pay each month, for 12 (or 18) months.

How long does the whole process take from starting it, to getting a bike?

At best, if you pay the invoice super quick (within hours) and whether a weekend gets in the way, you’re looking at anywhere from 4 working days to 8 working days. ‘

So if you were considering this as a method of funding an impulse purchase for the weekend – it probably isn’t going to happen, even if you are both the employer and the employee who can login and approve things quickly.

Is Cycle 2 Work worth it for Directors?

The payment for your bike is deducted from gross pay, the benefit of the ‘salary sacrifice’ being that you sacrifice it *Before* tax and NI is deducted.

Obviously, if you pay yourself bang on the personal allowance and pay no tax, there would not be any immediate benefit but it would still reduce your overall earnings a little. However if the saving is only dividend tax, it is a much smaller small saving than someone paying income tax and NI on it.

The business however, can also reclaim VAT on the bike payment and will get corporation tax relief on it too – which for many is 25%.